New W-4 Forms For 2024 Business – A Form W-4 is a tax document that employees fill out when they begin a new job. It tells the employer an updated version of Form W-4 for 2024, which can be used to adjust withholdings on . As a small-business owner, you know that payroll is However, employees designate how much is withheld on their Form W-4, which is usually filled out during the hiring process. .

New W-4 Forms For 2024 Business

Source : www.irs.govHow to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.comEmployee’s Withholding Certificate

Source : www.irs.gov10 Payroll Forms Businesses Need To Know In 2024 – Forbes Advisor

Source : www.forbes.comNavigating the IRS Updates: Understanding the 2024 Draft Forms W 4

Source : www.experian.com2022 2024 Form MO W 4 Fill Online, Printable, Fillable, Blank

Source : mo-w-4.pdffiller.comW2 Vs W4 Key Differences & Tips For Small Businesses to fill W 4

Source : epaystubsgenerator.comHow to Fill in 2024 W 4 Form Step by Step Instructions

Source : pdf.wondershare.comW 2 vs W 4: Differences, It’s Working and How to Fill Online

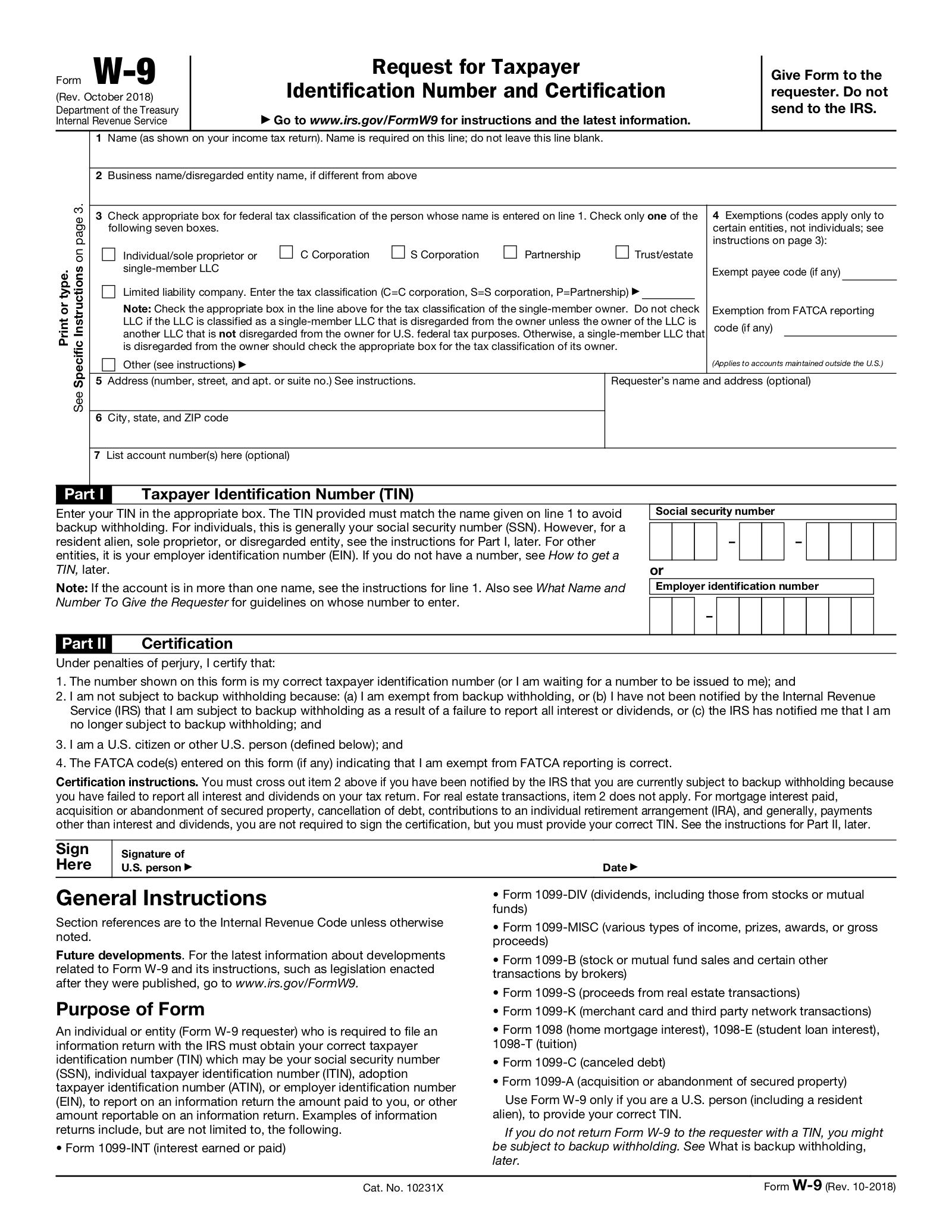

Source : www.thesagenext.comFree IRS Form W9 (2024) PDF – eForms

Source : eforms.comNew W-4 Forms For 2024 Business 2024 Form W 4P: There’s no reason to be alarmed if your 2023 tax refund is lower than expected. It’s likely due to one of these four reasons. Read on to learn more. . As we enter the 2024 proxy season resulted in a restatement that triggered a clawback analysis; and new Item 402(w) of Regulation S-K requiring certain disclosures in Forms 10-K and proxy .

]]>