Form 1040 Schedule Se 2024 Schedule – Tax season has started for 2024. Find out when you need to file your taxes with the IRS and your state, and when you can expect your refund. . Complete IRS form 1040 “Schedule C, Profit or Loss From Business.” Complete IRS Form 1040 Schedule SE, “Self-Employment Tax.” With these two forms, you are able to report your business .

Form 1040 Schedule Se 2024 Schedule

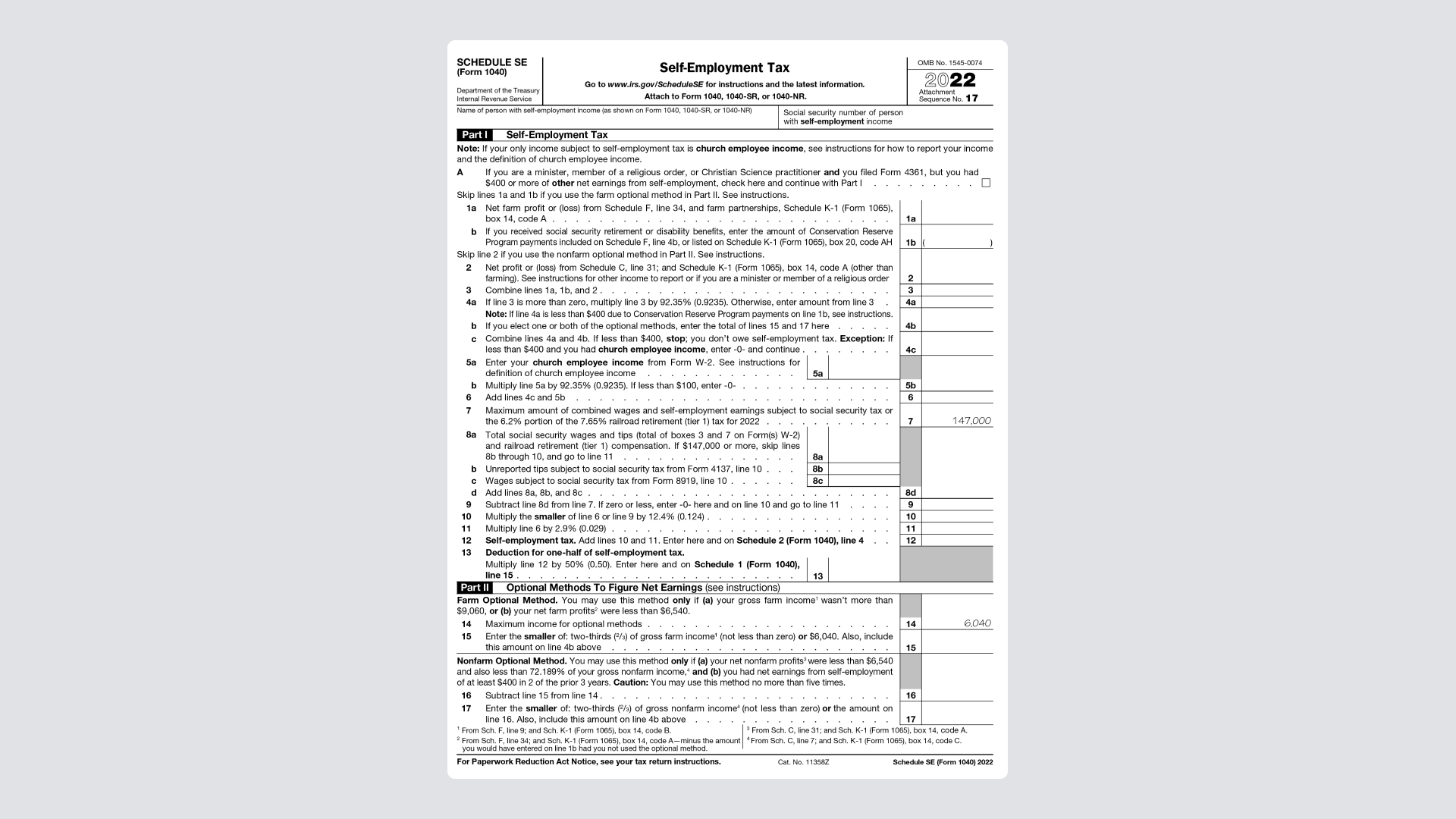

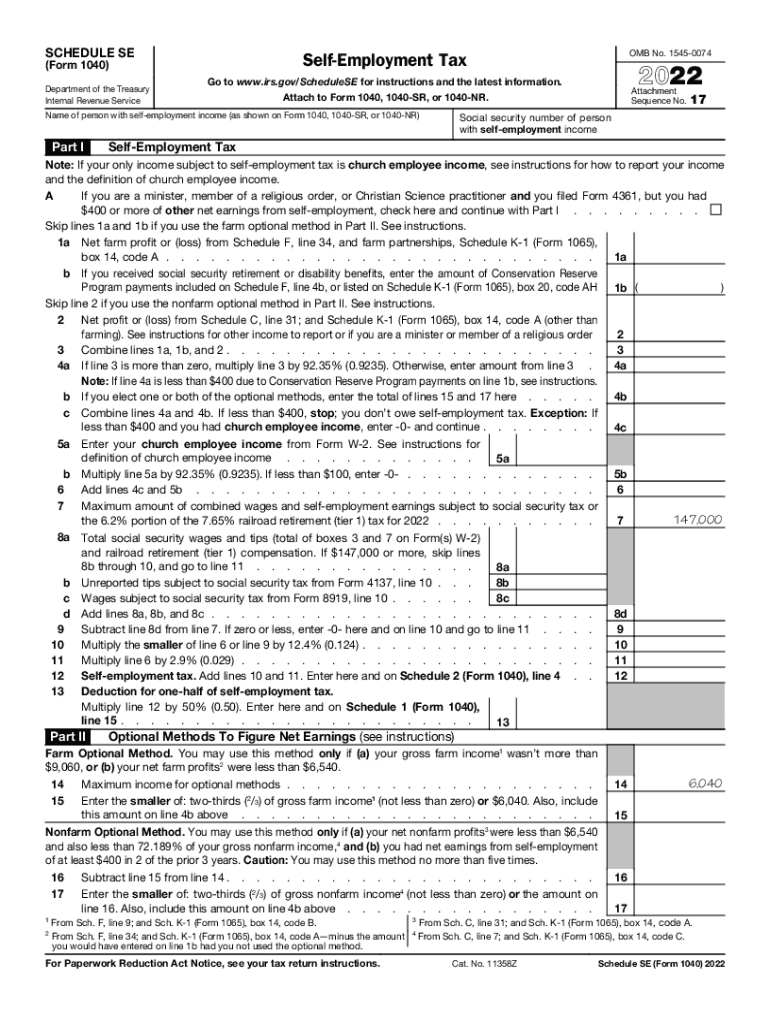

Source : found.comSE1204 Form 1040 Schedule SE Self Employment Tax (Page 1 & 2

Source : www.nelcosolutions.comIRS Schedule SE (1040 form) | pdfFiller

Source : www.pdffiller.comSE1204 Form 1040 Schedule SE Self Employment Tax (Page 1 & 2

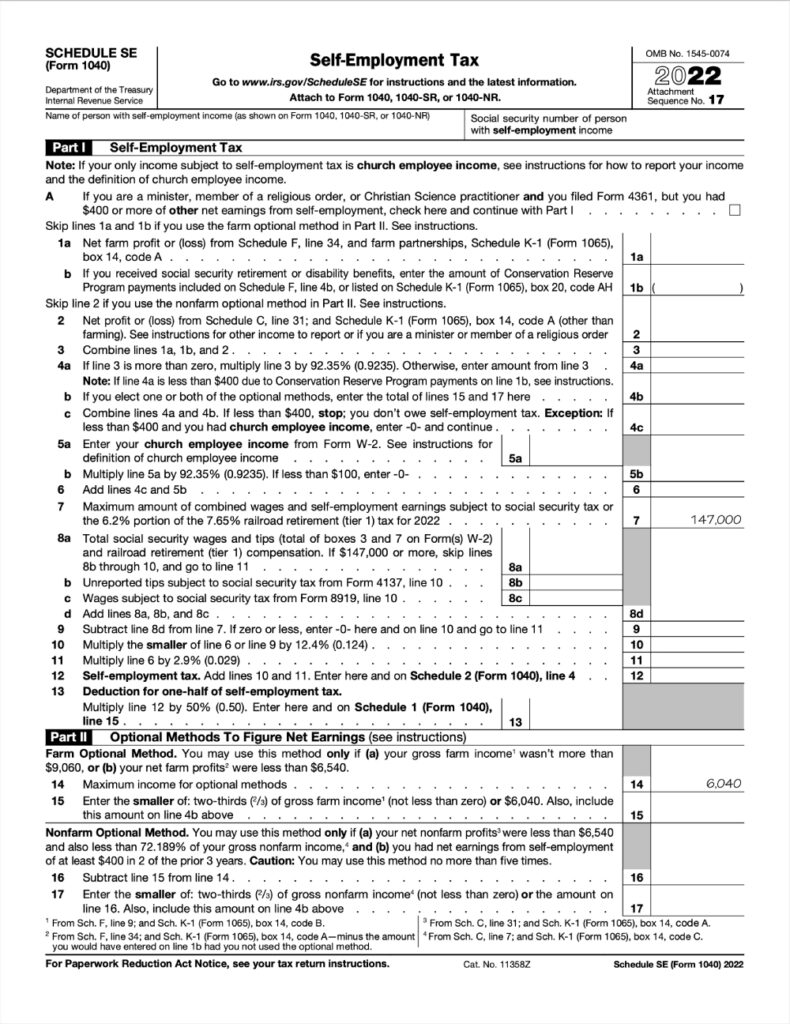

Source : www.greatland.comSchedule SE: Filing Instructions for the Self Employment Tax Form

Source : lili.coA Step by Step Guide to the Schedule SE Tax Form

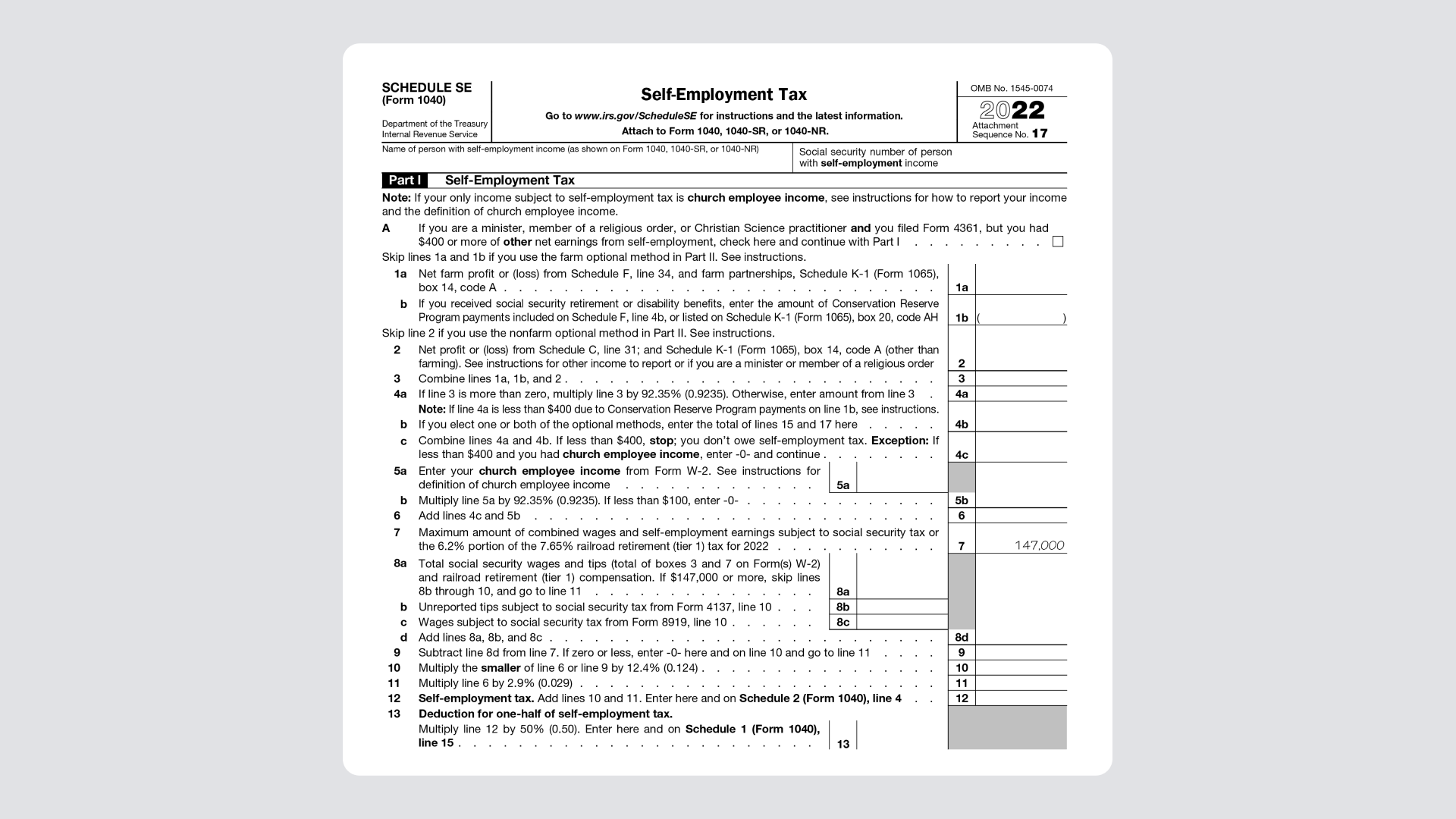

Source : found.comSE1204 Form 1040 Schedule SE Self Employment Tax (Page 1 & 2

Source : www.nelcosolutions.comSelf employed taxes 2022: Fill out & sign online | DocHub

Source : www.dochub.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

Source : www.irs.gov2023 1040 schedule se: Fill out & sign online | DocHub

Source : www.dochub.comForm 1040 Schedule Se 2024 Schedule A Step by Step Guide to the Schedule SE Tax Form: Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024 well as deductions for self-employment tax, student .

]]>