Are Employee Business Expenses Deductible In 2024 Year – Deductible business expenses incurred by the company reduce the net income for the year and thus reduce the Unreimbursed Employee Business Expenses An owner-shareholder-employee of an S . However, if you take the standard deduction your first year having a business. In fact, before the Tax Cuts and Jobs Act, you could deduct some work-related expenses even as an employee. .

Are Employee Business Expenses Deductible In 2024 Year

Source : www.freshbooks.com2024 State Business Tax Climate Index | Tax Foundation

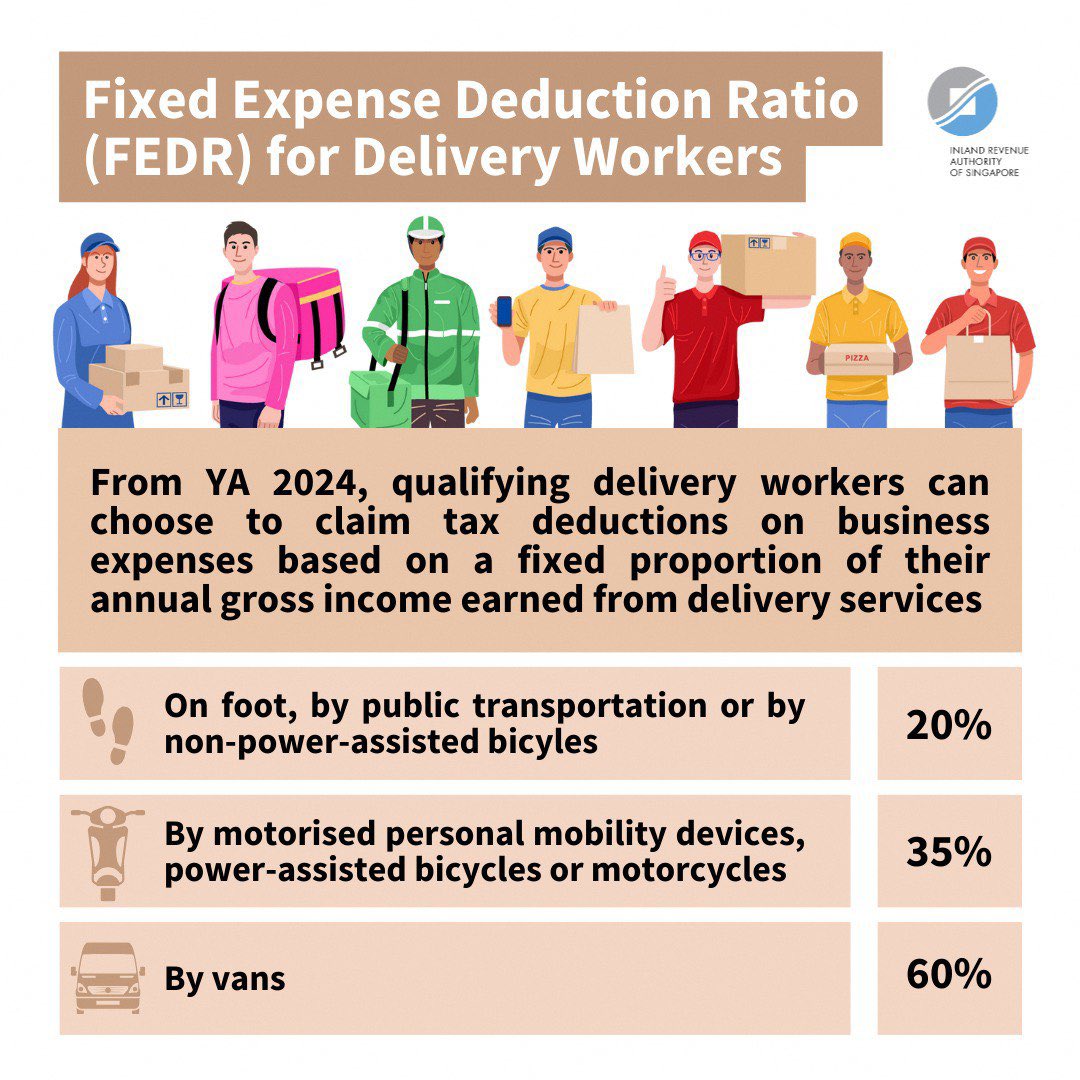

Source : taxfoundation.orgIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comMcDaniel & Associates, P.C. | Dothan AL

Source : www.facebook.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com🚗💨 IRS announces 2024 Standard Mileage Rates! 📈💼 | SIA Group

Source : www.linkedin.comVan Beek & Co., LLC | Tigard OR

Source : m.facebook.com2024 Calendar Year Updates – Allowances, Payroll Rates

Source : fazzaripartners.comMark R. Stanhope CPA PC | Hudson MA

Source : m.facebook.comAre Employee Business Expenses Deductible In 2024 Year 25 Small Business Tax Deductions To Know in 2024: The biggest deductions for work expenses are restricted to self-employed people and small business an employee or self-employed and how to claim them when you file your tax return this year. . Expenditures for business for the current year. Business expenses. Common expenses for running a business for which you can take a deduction include advertising, employee benefits, insurance .

]]>